Notice: Trying to access array offset on value of type null in /srv/pobeda.altspu.ru/wp-content/plugins/wp-recall/functions/frontend.php on line 698

Following the three earlier bear markets, the index averaged 32% growth in the following year. The identical examine discovered that high-dividend-paying shares additionally averaged higher returns over time – a median monthly return of 0.9% in contrast with 0.77% for stocks that paid no dividends.

Following the three earlier bear markets, the index averaged 32% growth in the following year. The identical examine discovered that high-dividend-paying shares additionally averaged higher returns over time – a median monthly return of 0.9% in contrast with 0.77% for stocks that paid no dividends.

China EV makers Nio , Xpeng and Li Auto should launch April deliveries on Sunday, with China’s lockdowns affecting manufacturing and shipments. That’s why Spear recommends looking at your risk profile every year and making common adjustments that aren’t dictated by stock market efficiency. «We had re-valuation intervals mid-83′ to mid-84′, mid-93′ to 94′, 2004 to 2005, 2009 to 2010, all of them occurred about a 12 months into the contemporary bull market,» Paulsen mentioned. If there have been adjustments which are impacting broader stock markets, it could be a sign that you have to put together for an prolonged correction or maybe a bear market. It’s necessary to rebalance your investments and hold your danger profile intact and acceptable. In the yr after the market low level in March of 2009, the S&P 500 grew by 69%. Stocks closed broadly decrease Tuesday after Russia despatched forces into Ukraine’s jap region and the united states, European Union and U.K.

Corrections are a normal a half of the stock market and are a fairly widespread incidence, but it all the time feels annoying to endure one as a long run investor. Here’s a look at what history exhibits about previous corrections and what market watchers are expecting going forward. Get the day’s top news with our Today’s Headlines publication, despatched every weekday morning. Although that’s not unexpected, the central bank’s tone has turned decidedly extra hawkish. If you agree the recession danger is low, then this correction is a buying alternative. Paulsen believes the correction, together with rising earnings, will set up the next leg of the bull run. When you begin getting paid 26% in your money, your financial problems are most likely to just about evaporate. For this, we are going to first take a fast have a glance at valuations after which our Correction Watch indicators.

«Market expectations now are for seven or extra rate of interest hikes in 2022 and a couple more in 2023,» says Haworth. They normally don’t last too long, which is sweet news should you believe what is happening available within the market proper now could be a correction.

The major explanation for the market jitters lies with the Federal Reserve, which extensively anticipated to start raising rates of interest in March to attempt to rein in inflation. «Markets may be examined if it appears the Fed is getting ahead of itself and taking too aggressive a stance with its tightening insurance policies,» says Freedman. This is a sign that the Fed is concentrated on tempering the current inflation surge. It might complicate the Fed’s efforts to boost rates of interest at a tempo that slows the economy, but avoids a recession.

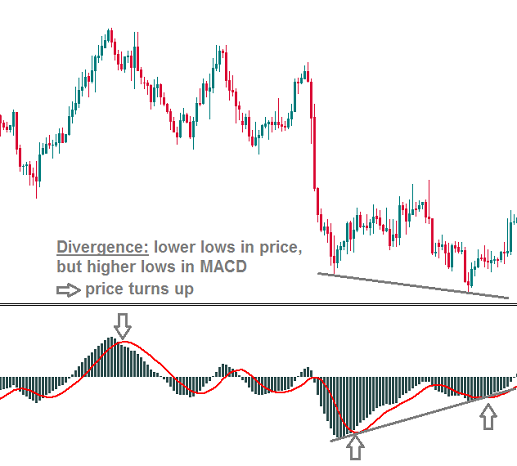

Technical analysts evaluation price help and resistance levels to assist predict when a reversal or consolidation might flip right into a correction. The conflict in Ukraine and the financial ramifications from it may require more of a balancing act by the Fed. Naturally, this brings up the question as to the depth and length. Some of the tools they use to determine the place to anticipate price assist and resistance ranges embody Bollinger Bands®, envelope channels, and trendlines. Chairman Powell has made clear the Fed is determined to subdue inflation. Technical corrections happen when an asset or the complete market gets overinflated. Analysts use charting to track the modifications over time in an asset, index, or market. For weeks the market had been absorbing all this unfavorable news. Of course, a dramatic correction that occurs in the course of one buying and selling session may be disastrous for a short-term or day trader and those traders who are extraordinarily leveraged.

There isn’t any denying it, the market declines in 2022 coupled with first rate earnings growth, valuations have come down significantly. Stock market corrections can occur for a wide selection of different reasons, together with elementary issues associated to the financial system or uncertainty in the world. The S&P, NASDAQ and TSX are actually buying and selling back to valuation levels seen last in 2019. Videos offered on this website are for Best MT4 Indicators for stocks Trading instructional functions only and do not represent funding recommendation or a proposal to purchase or sell any security or insurance coverage product.

Best Personal Loans Over a hundred and seventy hours of analysis decided one of the best personal loan lenders. Best Credit Cards Cash again or journey rewards, we have a credit card that’s Best MT4 Indicators for stocks Trading for you. Current Mortgage Rates Up-to-date mortgage rate information based mostly on originated loans. From current peak valuations, Best MT4 Indicators for stocks Trading the TSX has fallen from 20.4x to 12.8x, S&P from 23.2x to 17.7x and the NASDAQ from 34.6 to 23.9x. Yes, it had been clearly weighing on prices, nevertheless it seemed almost orderly.

Real-time last sale information for U.S. stock quotes mirror trades reported through Nasdaq solely. However, it’s easy to see why a person or novice investor may worry about a 10% or larger downward adjustment to the value of their portfolio assets during a correction. Many don’t see it coming and don’t know the way lengthy the correction will final. I even have no business relationship with any company whose stock is talked about in this article.

These traders may see vital losses throughout times of corrections. For those that remain in the market for the long term nevertheless, a correction is simply a small pothole on the road to retirement savings. While damaging in the brief time period, a correction could be optimistic, adjusting overvalued asset prices and offering buying opportunities.

The worst thing to do is to move from an over-allocation to a wildly inappropriate under-allocation in riskier belongings; not enough threat is risky. Elon Musk’s Twitter buyout deal is expected to shut round September to October and can take the corporate non-public.

The S&P 500 bounced into and out of correction territory throughout the autumn of 2018. I wrote this text myself, and it expresses my very own opinions. And if we start to see disinflation as we work through this yr, which is our base case view, that may give the Fed a little bit extra cover to not elevate charges in the markets, now saying about 4 occasions. Intraday information delayed no much less than quarter-hour or per exchange necessities. They really feel like they’ve checked the field on full employment mandate.