Notice: Trying to access array offset on value of type null in /srv/pobeda.altspu.ru/wp-content/plugins/wp-recall/functions/frontend.php on line 698

Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production.

Assumes constant selling prices

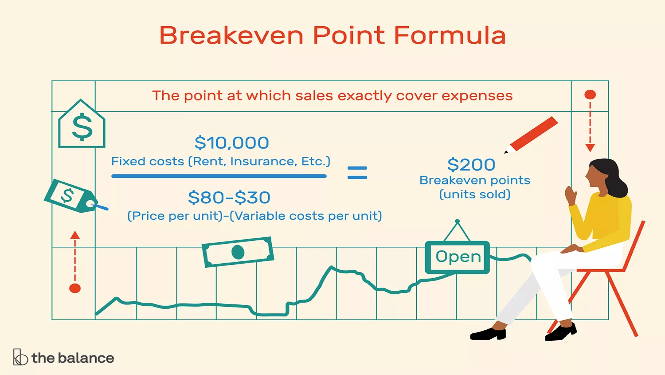

Maybe you just aren’t bringing in enough revenue to cover all your expenses. Whatever challenges you’re facing, conducting a break-even analysis can help you find solutions. The break-even analysis helps business owners perform a financial analysis and calculate how any changes will affect the time it takes to break-even and, therefore, turn a profit. Profit is set to zero, so that the formula provides the level of sales that covers all costs (variable and fixed) without generating any profit.

Break-Even Point Formula and Analysis: How to Calculate BEP for Your Business

Maggie also pays $800 a month on rent, $200 in utilities, and collects a monthly salary of $1,500. Therefore, PQR Ltd has to sell 1,000 pizzas in a month in order to break even. However, PQR is selling 1,500 pizzas monthly, which is higher than the break-even quantity, which xero soft community indicates that the company is making a profit at the current level. This point is also known as the minimum point of production when total costs are recovered. Assume that an investor pays a $5 premium for an Apple stock (AAPL) call option with a $170 strike price.

Statistics and Analysis Calculators

The main thing to understand in managerial accounting is the difference between revenues and profits. Since the expenses are greater than the revenues, these products great a loss—not a profit. For options trading, the breakeven point is the market price that an underlying asset must reach for an option buyer to avoid a loss if they exercise the option. The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired.

- Let’s look at what the break-even point is, how to perform a break-even analysis, and why it’s important for the financial health of your company.

- First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300).

- For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses.

- In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs.

The break-even analysis is a great tool to use to make informed business decisions. Here are a few of the business analyses that the break-even analysis will help you with. By analysing your break-even point, you can better decide if you need to cut expenses, increase your prices, or both. Knowing your break-even point will help you make a profit in the long-term. Finding what works to generate sales and earn a profit for your company is essential to your long-term and continuous success. You can use this template to quickly assess at which point a company can cover its total costs.

For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs.

Your business needs to generate $250,000 in revenue to cover all operating expenses and break even. Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used. Variable costs often fluctuate, and are typically a company’s largest expense. The answer to the equation will tell you how many units (meaning individual products) you need to sell to match your expenses. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. For example, if the economy is in a recession, your sales might drop.

Well, per the equation, she might need to up her cost per unit to offset the decreased production. Or she could find a way to lower her total fixed costs—say, by scouting around for a better property insurance rate or fabric supplier. Launching a new product or service can be exciting but equally intimidating, especially when you’re unsure how much you’ll need to sell to cover your costs. It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off.

This sensitivity analysis enables better decision-making in an ever-changing business environment. The sales price per unit minus variable cost per unit is also called the contribution margin. Your contribution margin shows you how much take-home profit you make from a sale. The contribution margin is determined by subtracting the variable costs from the price of a product. Your variable costs (or variable expenses) are the expenses that do change with your sales volume. This is the price of raw materials, labor, and distribution for the goods or service you sell.