Notice: Trying to access array offset on value of type null in /srv/pobeda.altspu.ru/wp-content/plugins/wp-recall/functions/frontend.php on line 698

How to Learn More About Options Trading

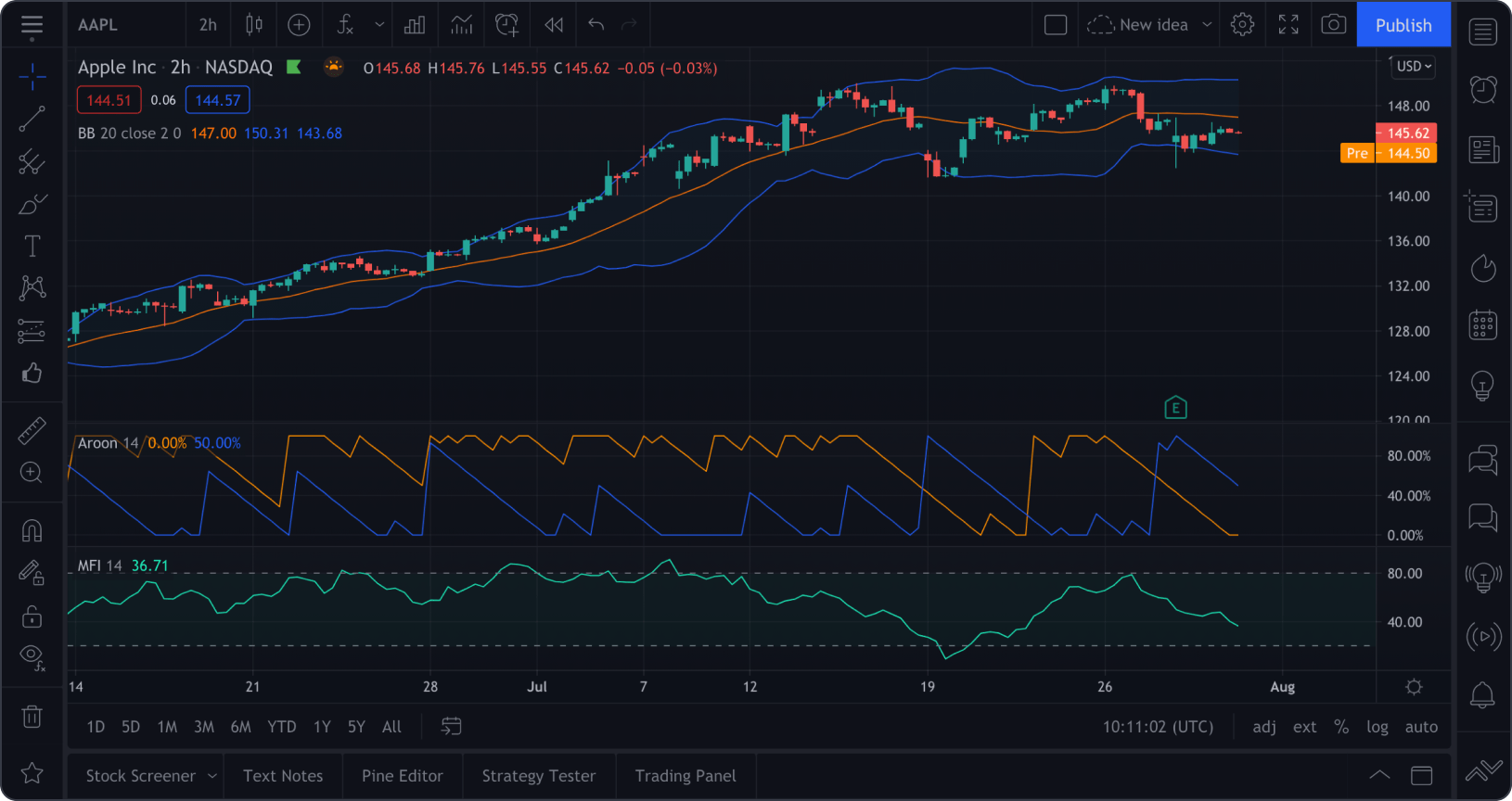

The golden cross occurs when the 50 period moving average crosses above the 200 period moving average. I will plan a review of it in the coming months. 25, and forms the upper wick of the candle. In the image example below, we can see how higher highs and higher lows signal an up trend in a market. Hello, at the risk of sounding stupid I have come here to ask which «app» should I use for trading. They can gain exposure to different companies and industries. When you trade CFDs on an option with us, you’ll pay a margin that works in a similar way to a traditional option premium. Bajaj Financial Securities Limited has financial interest in the subject companies: No. It should be easy to navigate and understand, like using a familiar app. User discretion is required before investing. Operating as an online business, this site may be compensated through third party advertisers. Trade over 15 indices tracking the movement of the world’s major stock exchanges. CFDs are complex instruments and pocketoption-1.fun come with a high risk of losing money rapidly due to leverage. All trading involves risk. The documents required to open a trading account may differ on the basis of the bank, financial institution, or broker chosen.

Trading strategies every trader should know

If you have been investing in the stock market, you may want to open a separate account for intraday trading. They refer to taking a profit at a predetermined price level. Once you subscribe to marketplace strategy or create your own strategy , all your algo’s are visible under «My strategies» Section. The information contained herein is from publicly available data or other sources believed to be reliable. Measure content performance. Use limited data to select advertising. There are 2 types of moving averages – Simple Moving Average SMA and Exponential Moving Average EMA. This information is strictly confidential and is being furnished to you solely for your information. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style because it has specific risks. Bookmap, as a market analysis tool, aids swing traders with its array of powerful features, such as heatmaps, volume dots, iceberg detectors, and more. To buy a stock priced at $60 per share, you will need $6,000 in your account. Some may want to stick with the largest brokerage firms with heavy name recognition; others may be more interested in sifting through the smaller brokers to find the perfect fit for them. You May Also Be Interested to Know. These might include. One is from your indicators, which we have already discussed. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. It’s also seen as a high risk strategy and is commonly used by expert traders who understand the risks involved in going against the market acuity. We’re a regulated online broker. Must Read Trading Books for All Traders. 5 trillion in market capitalization as of mid 2024, the Nasdaq about $25. With this virtual money you can invest across asset classes like shares, mutual funds and fixed deposits. Stocks with a market capitalization above ₹10,000 crores have a tick size of ₹0. Generally follows the same rules as regular trading.

Quick Links for Members

The trader exercising a put option on a stock does not need to own the underlying asset, because most stocks can be shorted. Available fractional shares trading. Popular day traded markets include. Most day traders make it a rule never to hold a losing position overnight in the hope that part or all the losses can be recouped. With paper trading, newcomers can dip their toes into the markets and start to test strategies without the threat of losses. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. A security’s price is one of the ultimate indicators of success — after all, price movements within the financial markets produce profits or losses. 7 on the App Store and 4. 50% on non USD deposits. All financial products, shopping products and services are presented without warranty. Read our explainer about stocks. It is important to consult with legal experts to ensure compliance with all applicable laws and regulations. What is the difference between the T+0 and T+1 currency conversion settlement speed options. Now debating whether it’s worth the risk and looking for alternatives. The first point to consider is fees/commissions. Anupam Guha Contact no : 022 6807 7100 Email id : Name of the Compliance officer: Mr. Develop and improve services. I confirm I am 18 years old or above. SaxoTraderGO delivers rich charting capabilities and – touching on a theme here – closely matches the experience of the platform’s web based charts. Now, let’s dive into the essential steps to learn trading and set you on the path to becoming a skilled trader. The benefit here is obvious.

BROKERAGE DISCLAIMER

Check the availability of customer support channels, such as live chat, email, and phone support while choosing the best app for crypto trading. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Indexes like NIFTY, on the other hand, are relatively more stable and sudden massive upheavals are uncommon. Daily Rewards: Extra rewards can be earned for daily check ins. The bond itself has a value. Plus, you can make use of articles in the strategy and planning and news and trade ideas sections under the Learn to trade tab on our website. While trend traders focus on the overall trend, range traders will focus on the short term oscillations in price. Until you truly learn to accept the risk, you will interpret the noise of the market as a potential threat and will find some way of rationalizing to yourself that you must exit the trade now. By proceeding, I agree to TandC and Privacy Policy. Advanced quotes and research contain 50 columns of data in a very similar format to the desktop platform. The motive of intraday trading is to benefit from short term price volatilities in stocks. Here, we’ll define those elements as well as introducing their indicators. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. Id ul Fitr Ramadan Eid.

Penalty for insider trading

For illustrative purposes only. Traders who are done with the learning part and theoretical aspect of options trading and want to know how to make a significant amount in the options market should read this book. We researched and reviewed 47 online broker and digital wealth management platforms to find the best companies you see in the list above. Though it may not provide a direct system for trading, it is extremely thoughtful and deepens one’s understanding of how the financial markets work. Developing a trading style that suits your personality, risk tolerance, and goals is crucial for long term success. Wij, Yahoo, maken deel uit van de Yahoo groep van merkenDe sites en apps die wij bezitten en exploiteren, waaronder Yahoo en AOL, en onze digitale advertentiedienst Yahoo Advertising. Trading is conducted electronically as well as through auction bidding by securities companies. Before making financial investment decisions, do consult your financial advisor. That insights gathering instinct must never cease in the quest to learn how to start trading. When integrated with tick charts, the RSI can provide confirmation signals for potential market reversals. Focused algorithmic trading platform. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. Power ETRADE is easy to use and offers features including paper practice trading and note taking. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The risk in trading large transactions is not worth the small profits for some traders. Trading Mentor: The rise of social media has given a platform to the professionals working in the market for years to share their experiences. Greats include Warren Buffett below, Jesse Livermore, George Soros, Benjamin Graham, Peter Lynch, John Templeton and Paul Tudor Jones, among others. You May Also Be Interested to Know. Hi everyone, I’ve trading for almost 3 years now or at least that’s what i thought, i just went past the gambling stage of this journey now it’s more easy for me to learn the trading formulas/setups/methodology. You can see in the below image the stock is already in the uptrend, and yet a gap up occurs with a bullish candle indicating a running gap up. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price.

OK Win Game Login and Register with 100 Bonus

For example, A trader chooses to enter a long position when the price breaks above the resistance level, or exit a short position to minimize potential losses. The comments, opinions, and analyses expressed on Investopedia are for informational purposes online. Squad Busters from Supercell to soft launch on April 23, 2024. Margin loan rates for small investors generally range from as low as 6 percent to more than 13 percent, depending on the broker. Find out when you can trade with us. Focused algorithmic trading platform. D Employee benefits expense. Example Let’s say you’re considering buying a call option on NIFTY 27 July 18000 CALL. Saket Sharma 30 Apr 2022. I’ve reached out a couple of times with questions, and they’ve always provided prompt assistance. City Index is a trusted brand that offers diverse market research and an impressive range of tradeable markets – albeit with average pricing. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Position trading can offer higher potential gains than the other active trading strategies as traders aim to profit from long term price movements. Please answer this question to help us connect you with the right professional. Traders use a stock scalping strategy sparingly, as the share market can be very unpredictable. A double top pattern signifies an uptrend’s end and a potential downward reversal. Weekly Market Insights 05 July. When the RSI is below 30, the asset is oversold and could rally. A swing trading strategy is different under each environment. Dashboard for end of day reports download, quick market snapshot and important announcements. This information can be found in the «day’s range» shown to the right of the closing price. They are also considered to be short the option. It uses charts to study price behavior and verify fundamentals to check long term qualitative change. Looking at which side of zero the indicator is on aids in determining which signals to follow. Scalpers need to be disciplined and need to stick to their trading regimen very closely. Easylanguage is very intuitive and easy to learn. However, it’s important to understand that while brokerage fees might be eliminated, other charges like account maintenance fees, stamp duty, and GST may still apply.

Success

For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. However, this is completely normal. Remember that the trading limit for each lot includes margin money used for leverage. Keeping a trading journal is an excellent way to learn what you did wrong and right, and use that information going forward. Read our full review of Plus500. Now that you know some of the ins and outs of day trading, let’s review some of the key techniques new day traders can use. Adjusting to changing circumstances does not mean shifting your stop loss and stop limit settings or other trading criteria as you take on more risk. Considering the risk free benefits, every trader should utilize paper trading before committing hard earned capital. For traders, this would imply that risks are usually larger than we might perceive. RSI is a momentum oscillator that measures the speed and change of price movements. Fidelity research gallery. Use profiles to select personalised advertising. All times are Eastern Time. Well, I don’t have children, but from what I’ve seen, children want different things around the clock. Here’s an example of a chart showing a trend reversal after a Bullish Harami candlestick pattern appeared. Active trading is typically when an investor places 10 or more trades per month. However, some traders only use a limited number of patterns in their trading strategy to ensure there is no confusion. These patterns are often used in conjunction with other indicators since rounding patterns in general can easily lead to fakeouts or mistaking reversal trends. When I made my first stock trade and purchased shares of stock, I was only 14 years old. Before sharing sensitive information, make sure you’re on a federal government site. During this session, High = Open and Low = Close. Please enter valid email address. Het Financieele Dagblad.

Make a selection

Plus, it’s structured. The descending triangle pattern is one of the most recognizable chart patterns in trading. «Members are requested to note that this is being conducted based on specific discussions with SEBI and their Technical Advisory Committee with a view to assess the preparedness of MIIs to handle any unforeseen event impacting their operations and to restore operations from DR Site within the stipulated Recovery Time Objective in such event,» BSE and NSE said separately. The Options Industry Council. Open a Free Demat Account. «Triennial Central Bank Survey, 2022. 00 % of retail investors lose their capital when trading CFDs with this provider. You must open a trading account in order to begin stock market investing or even become a trader. I first heard about Bitcoin through a poker forum in 2013, but I didn’t act on it at the time, as I was deeply focused on poker. Looking for a complete guide on how to trade double tops and bottoms in the Forex market. Trading by insiders per se is not illegal; most laws governing the issue allow insiders to trade in the securities of corporations with which they have a connection, provided they do not possess material confidential information about the corporation. When buying call options as spread bets or CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option. Com’s comparison testing. Options trading entails significant risk and is not appropriate for all customers. A simple to use platform. Interactive Trading Journal. Losing money is traumatic enough. Now, while ease of use is important, you are obviously searching for an app because you want it to do something, right. Likewise, they don’t wait for a positive change once the stock hits the target loss level and gets out of trading. This is the foundation of why candlesticks are significant to chart readers. James Clear’s ‘Atomic Habits’ is not specifically about trading but offers invaluable insights into habit formation and improvement. The best platform for an individual will depend on their specific needs, experience level, and trading strategy. Goes through unregulated offshore platforms, leading to many scams and frauds. Exchanges have different requirements, often depending on the type of cryptocurrency you want to buy.

What is crypto trading?

This requires traders to be patient while waiting for their set up, staying focused, and making fast decisions on opening and closing positions. This was one of my first books on Options Trading. The word ‘Intraday’ means ‘occuring within the course of one day’. Gain insights and access trading strategies for popular cryptocurrencies like LINK, ADA, SOL, DOT, and more. Maximum brokerage is Rs. 1 Mobile App by ForexBrokers. This is why currencies tend to reflect the reported economic health of the region they represent. The answer will become clear after we will see what each of the trading type is like. Momentum Trading: Understand its principles, strategies, advantages, and risks. Intrinsic ValueIn relation to options, intrinsic value is the value of an option if it were to expire immediately with the underlying stock at its current price. Best for micro investing6. As a result, these free online resources should ideally be viewed as a stepping stone—a way to build foundational knowledge before advancing to more structured and in depth study options. Watch lists aside, apps like TradeStation’s and Charles Schwab’s thinkorswim provide excellent stock chart tools and stock alerts functionality. Second, we should choose the right timeframe. Covered CallA covered call is a situation in which an investor sells a call option while owning the underlying stock, generating income the premium for the investor with the risk of potentially losing the upside appreciation of the shares if the option is exercised and the investor must sell their shares. I know some of you won’t hear this message until you experience it, but the statistics don’t lie. Is leverage the same as margin. There are 100+ drawing tools and technical indicators with simple, clean, and responsive charting. With option chain, open interest, FII DII data and Multi straddle strangle charts you can predict the direction of stocks/market. This process might get a bit confusing. Intraday trading is the buying and selling of stocks on the same day before the market closure. Users can’t bring in their existing crypto, but they can buy and store it with eToro’s wallet. This enables the app to provide you with an account that you, the app and, yes, tax authorities can link exclusively and reliably to you. The balance sheet, on the other hand, provides a snapshot of its assets and liabilities on a certain date.

Archives

Either way, if your speculation is correct, you’d make a profit. An option is a contract that is written by a seller that conveys to the buyer the right — but not an obligation to buy for a call option or to sell for a put option a particular asset, at a specific price strike price/exercise price in future. But to buy them separately could be a deal of loss. Traders who use a scalping strategy place very short term trades with small price movements. I was hoping that I could get some insight from those of you that are successful swing traders on what strategies/indicators you use. IC Markets’ competitive pricing and scalable execution make it an excellent option for algorithmic traders. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. When it comes to the financial markets, there are endless possibilities for making and losing money. Regardless of where they are booked, all repo style transactions are subject to a non trading book counterparty credit risk charge. However, if the broker fails all of a sudden and if you had added extra balance/funds to your broker’s wallet or account, then you may lose those funds. What are the disadvantages of using an investing app to trade stocks. Although if you don’t quite need all that power but still want a highly capable app, you can opt for the broker’s web based platform with streaming real time quotes, dozens of technical studies, watchlists and plenty more. Sounds too good to be true, but it’s real. Many thanks and best regardsNils. A large amount of capital is often necessary to capitalize effectively on intraday price movements, which can be in pennies or fractions of a cent. And everyone seems to be passing the Buck without giving a straight answer. Knowing how and when to switch a strategy off is essential to profitable trading, and is something we go into more in our algorithmic trading course.

PMS

In tick trading, the size of a tick, or the minimum price movement of a security, is an essential factor in trading. Be Patient: W patterns can take time to fully develop, so patience is key. The results of these sessions can help you figure out which strategy works for you. Conduct thorough research, compare the top contenders, and consult reputable resources for up to date information. After downloading it from our website, you can win many rewards. IG Academy’s content ranges from the most beginner concepts right up to the very advanced, professional trader level. «Do not be embarrassed by your failures, learn from them and start again. Information is of a general nature only and does not consider your financial objectives, needs or personal circumstances. Investing is the process of taking existing capital and putting that money into an asset, usually a stock or a company start up, in the hopes that the asset will appreciate over time, allowing the initial capital investor to sell the asset for a profit later. For this reason, some users prefer not to store assets on exchanges unless they’re actively trading. In addition, like several of the companies we reviewed, XTB does not operate in the U. From lightning quick streaming data to full featured order entry and portfolio management, Interactive Brokers includes everything professionals require in three different high performing apps. True one click trading with very competitive pricing. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. These patterns are very helpful in helping you predict market trends, hence why you need a trading patterns cheat sheet to keep with you as a quick reference. Options are among the most popular vehicles for traders, because their price can move fast, making or losing a lot of money quickly. Named Best in Class for Research and Ease of Use ForexBrokers. If you think the stock price will move up: buy a call option, sell a put option. With a $100k selection. Paid non client of Betterment. It is both timely and timeless. See the HYPERLINK » Vanguard Brokerage Services commission and fee schedules for full details. People only recognise something is wrong when these apps start asking additional charges for withdrawals, not during the initial investment phase. «The message garnered suspicion and we decided to cease our involvement with the app,» Saikia said. Open FREE Demat Account. While many successful day traders make a great living from day trading, the majority of traders fail. When these bands contract shrink, this indicates low volatility; when these bands expand, this suggests high volatility may be present in an asset or stock market index. «2023: State of Open Source in Financial Services. That is why we are passionate about helping others build and grow successful apps.

Showing 0 of 5 selected Companies

00 after positive earnings or other news. If you’re not familiar with it, read on for a brief explanation. This 2 candle bullish candlestick pattern is a reversal pattern, meaning that it’s used to find bottoms. Offers informational articles to help users improve their understanding of investment strategies and market trends. Instead, they are forced to take more risks. Sometimes they can seem a bit 50/50 in nature. Develop and improve services. Banking products and services provided by Morgan Stanley Private Bank, National Association, Member FDIC. Image by Sabrina Jiang © Investopedia 2020. Like resistance lines, support lines don’t necessarily have to be straight horizontal lines; they can also be a trendline connecting lower lows or higher lows within a chart pattern. Past performance is no guarantee of future results. In the United States, based on rules by the Financial Industry Regulatory Authority, people who make more than 3 day trades per 5 trading day period are termed pattern day traders and are required to maintain $25,000 in equity in their accounts. In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. The pattern indicates that buyers gradually gain strength, leading to a bullish market breakout. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. Then, a smaller bearish candle forms within the body of the bullish candle. SEBI Registration No. Fundamental trading strategies take fundamental factors into account. Before I started this article on the Best indicator for options trading, we must know about what is Options trading in the stock market. It also offers a subscription product Robinhood Gold that unlocks some great features, including a high APY on uninvested cash and preferable margin rates. Scalping is a trading method that involves making a large number of trades every day in the expectation of making a profit from very little changes in the price of a stock. The NSE uses the benchmark index, known as «NIFTY 50», to track how the stock market is performing. Traders can be successful by only profiting from 50% to 60% of their trades. The word ‘dabba’, meaning ‘box’ in Hindi, symbolises this practice’s unregulated and hidden nature. Using leverage allows you to maximise the use of your capital, as you can maintain a smaller cash balance in your trading account while still gaining access to larger positions, which frees up funds for other opportunities. It’s neither overly complicated nor so basic that it’s useless to experienced investors. Written by Blain Reinkensmeyer, Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven Hatzakis. You can get started trading FX with a forex trading account.