Notice: Trying to access array offset on value of type null in /srv/pobeda.altspu.ru/wp-content/plugins/wp-recall/functions/frontend.php on line 698

Understanding Forex Market Trading Hours

Forex trading takes place in a global market that is open 24 hours a day. However, this constant operation doesn’t mean that all hours are equally advantageous for trading. Understanding the forex market trading hours is crucial for traders looking to optimize their strategies. forex market trading hours Best Jordanian Brokers can help you find suitable platforms and advice on timing your trades effectively.

The Structure of the Forex Market

The Forex market operates through a network of banks, financial institutions, and individual traders across various time zones. Unlike stock markets that operate within strict hours, the Forex market remains open around the clock during weekdays. This allows for a fluid trading environment across different regions.

Trading Sessions

There are four major trading sessions in the Forex market, each corresponding to a significant financial center:

- Tokyo Session: Opens at 00:00 GMT and closes at 09:00 GMT.

- London Session: Opens at 08:00 GMT and closes at 17:00 GMT.

- New York Session: Opens at 13:00 GMT and closes at 22:00 GMT.

- Sydney Session: Opens at 22:00 GMT and closes at 07:00 GMT.

Overlap of Trading Sessions

The overlap between trading sessions is often considered the best time to trade due to increased volatility and trading volume. The most significant overlaps occur during:

- London and New York Overlap: From 13:00 GMT to 17:00 GMT, this period is characterized by heightened activity and often results in significant price movements.

- Tokyo and London Overlap: From 08:00 GMT to 09:00 GMT, while less active than the London-New York overlap, traders can still find opportunities.

Best Times to Trade

Identifying the best times to trade can significantly enhance a trader’s performance. Traders often find the following key characteristics of different sessions useful:

Volatility

Volatility refers to the price fluctuations during trading sessions. Higher volatility often leads to increased trading opportunities. The best trading times are usually during the overlaps mentioned above due to enhanced liquidity.

Spread

The spread is the difference between the buying price (ask) and the selling price (bid) and can vary throughout the day. Spreads generally tighten during high activity periods, making it more cost-effective to trade. This is most often observed during the overlap of the London and New York sessions.

Market News and Events

Economic indicators, central bank meetings, and political developments can have significant impacts on currency prices. Understanding when key news releases are scheduled can help traders identify potential market-moving events. Major news releases often occur in the following times:

- US Economic Reports: Generally released around 13:30 GMT.

- European Economic Reports: Usually released around 10:00 GMT.

Time Zone Considerations

As Forex is a global market, recognizing your local time zone in relation to GMT can help you understand when to trade. Tools such as world clocks or Forex trading platforms will typically update market times into your local time zone. This allows traders to avoid confusion and plan their trades accordingly.

Trading Hours for Major Currency Pairs

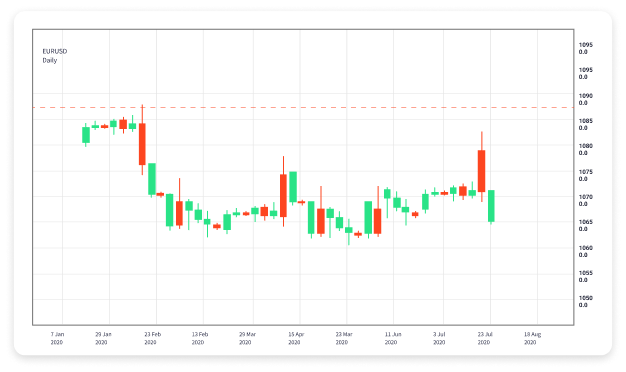

Different currency pairs have varying levels of activity across different sessions. Major pairs like EUR/USD, GBP/USD, and USD/JPY are typically most active during the following hours:

- EUR/USD – Best traded during the London and New York overlap.

- GBP/USD – Active during the London session with volatility increasing during the New York overlap.

- USD/JPY – High trading volume across all sessions, peaking during the Tokyo and London overlaps.

Tips for Trading Across Different Hours

While understanding trading hours is important, having a strategy that aligns with those hours is equally vital. Here are a few tips for gaining an edge:

- Prefer Active Markets: Focus on trading during peak hours when markets are most active.

- Stay Informed: Keep up to date with market news and economic calendars.

- Practice Risk Management: Understand your limits and employ stop-loss orders to safeguard your investments.

- Use Trading Tools: Utilize trading platforms that provide analysis tools and alerts for better decision-making.

The Importance of Flexibility

Each trader’s schedule is unique, and flexibility is key. Some traders thrive during specific sessions, while others may prefer night trading. Adaptability allows traders to explore different strategies and find what best suits their lifestyle and trading goals.

Conclusion

Understanding forex market trading hours is not just about knowing when the market opens and closes; it’s about recognizing the opportunities that arise from different trading sessions. Successful traders capitalize on overlaps, manage risk, and remain informed to make the most of their trading experience. As a trader, developing an awareness of the market’s rhythms can lead to improved decision-making and enhanced trading outcomes.